- Home

- ESG Initiatives

ESG Initiatives

Daiwa House Asset Management Co., Ltd. (hereinafter referred to as the “Asset Manager”) is dedicated to investing in and managing real estate and other assets across a broad range of sectors that meet social needs in pursuit of sustained unitholder-value accretion through stable revenue and steady growth of assets over the medium to long term. The Daiwa House Group’s basic approach is “Creating Dreams, Building Hearts.” As a group that co-creates value for individuals, communities and people’s lifestyles, the Daiwa House Group aims to build trust relationships with stakeholders and contribute to society through its business, and to realize a sustainable society by meeting the challenge of achieving “zero environmental impacts.”

The Asset Manager shares the Daiwa House Group’s basic approach and considers that including consideration for environment, society, and governance (hereinafter referred to as “ESG”) in its real estate investment management operations and advisory services contributes to ensuring stable revenue and steady growth of assets over the medium to long term.

Therefore, we have established the following “Sustainability Policy” to guide our real estate investment management.

Sustainability Policy

- Prevention of global warming

We will promote energy conservation measures through the installation of energy conservation equipment and so forth to realize a carbon-free society. We will also consider introduction of renewable energy power generation facilities and acquisition of properties that have such equipment installed. - Harmony with the natural environment (preservation of biodiversity)

We will aim for a society that is able to pass on abundant natural resources to future generations in order to protect and improve natural capital. We will also promote planting and management considering harmony with the surrounding environment. - Conservation of natural resources (protecting water resources, reducing waste)

We will work towards the realization of a recycling-oriented society by promoting water conservation measures through the installation of water conservation equipment. We will also promote 3R activities (reduce, reuse, and recycle) for resources. - Prevention of chemical pollution

We will aim to realize a society where people and ecosystems do not suffer adverse effects from chemical substances by promoting reduction, substitution and appropriate management of harmful chemical substances when managing real estate, and taking efforts to minimize risks. - Establishment of an internal framework and initiatives for employees

We will establish an internal framework for promoting sustainability and take steps to develop human resources by conducting regular education and training for officers and employees. We will also aim to create workplaces where people can work safely and healthily, and workplaces where diverse employees can work flexibly. - Building of trusting relationships with external stakeholders

We will aim to build trusting relationships with external stakeholders and we will work on our suppliers to enhance the satisfaction of tenant customers and promote CSR in our supply chain. We will undertake neighborhood co-existence activities with local residents. - Promotion of communication through information disclosure

We will proactively disclose ESG-related information and utilize dialogues with stakeholders, such as investors, in our future business activities. Furthermore, we will aim for continuous acquisition of Green Building Certification. - Compliance with laws and regulations, and risk management

We will comply with ESG-related laws and regulations. Moreover, we will strive to implement appropriate risk management, such as giving consideration for the environmental and social impacts in risk evaluations when acquiring real estate and promoting awareness of human rights.

■Initiative Support and Participation Policy

The Asset Manager shares the Daiwa House Group’s basic approach of “Creating Dreams, Building Hearts.” To attain a sustainable society, it is essential that we include environmental, social, and governance (“ESG”) considerations in real estate investment management operations. We also believe that this will contribute to DHR’s basic policy of ensuring stable revenue and achieving steady asset growth over the medium to long term. As such, DHR has been applying the above matters to its real estate investment management business.

The Asset Manager believes climate change, human rights, diversity, equity, and inclusion, and biodiversity are particularly important social issues to address. By joining the initiatives related to the above, we will continue to actively work on solving social issues.

■Signing on to Principles for Responsible Investment (PRI)

The “Principles for Responsible Investment (PRI)” is a network of internal investors endorsed by the United Nations Environment Programme Finance Initiative (UNEP FI) and the United National Global Compact (UN Global Compact). The investors who are signatories to the PRI declare to include ESG issues into investment decisions, and while helping the beneficiaries enhance long-term investment performance and fulfilling their fiduciary duty as responsible investors over the long term, they aim to create an abundant world for all stakeholders.

The Six Principles for Responsible Investment

- We will incorporate ESG issues into investment analysis and decision-making processes.

- We will be active owners and incorporate ESG issues into our ownership policies and practices.

- We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- We will promote acceptance and implementation of the Principles within the investment industry.

- We will work together to enhance our effectiveness in implementing the Principles.

- We will each report on our activities and progress towards implementing the Principles.

The Asset Manager agreed with the basic approach of the PRI and became a signatory.

■Participation in the Japan Climate Initiative (JCI)

The Japan Climate Initiative (“JCI”) is a network of Japanese companies, local governments, and NGOs that are actively working to prevent climate change, established in response to the 2015 Paris Agreement, aiming independently to realize a decarbonized society. JCI has created a nationwide movement in Japan to achieve a decarbonized society by supporting the activities of participating members, working on the governments, and partnering with the international society.

The Asset Manager joined the JCI as we agreed with this mission to realize a decarbonized society and joined the JCI after satisfying the participation requirements.

■Signatory of the United Nations Global Compact (UNGC) and Joining the Global Compact Network Japan (GCNJ)

The United Nations Global Compact (“UNGC”) is the world’s largest sustainability initiative for bringing together the United Nations and private organizations (companies/associations) and building a sound global society. UNGC is an independent initiative for companies and associations to act as a good standing member of society and achieve sustainable growth by exercising responsible and creative leadership.

Companies and associations who are signatories to the UNGC are making ongoing efforts to realize the ten principles related to the protection of human rights, elimination of all forms of unfair labor, response to the environment, and the prevention of corruption based on a commitment from top management at each supporting company.

Local UNGC networks in each country around the world act as a platform aiming to foster sustainable development. The Global Compact Network Japan (“GCNJ”) was launched in Japan in December 2003 as a local Japan network.

The GCNJ supports member companies and associations in Japan to take independent and strategic action toward the UNGC’s Ten Principles and engages in activities to realize a sustainable society, such as holding seminars and subcommittees made up primarily of member companies.

The Asset Manager agrees with the UNGC’s Ten Principles and has become a signatory. Furthermore, it has joined the GCNJ to take active action.

The Ten Principles of the United Nations Global Compact

| Human Rights | Principle 1 | Support and respect of the protection of human rights |

|---|---|---|

| Principle 2 | Not to be complicit in human rights abuses | |

| Labour | Principle 3 | Freedom of association and the effective recognition of the right to collective bargaining |

| Principle 4 | Elimination of all forms of forced and compulsory labour | |

| Principle 5 | Effective abolition of child labour | |

| Principle 6 | Elimination of discrimination in respect of employment and occupation | |

| Environment | Principle 7 | Precautionary approach to environmental challenges |

| Principle 8 | Initiatives to promote environmental responsibility | |

| Principle 9 | Development and diffusion of environmentally friendly technologies | |

| Anti-Corruption Principle | Principle 10 | Working against corruption in all its forms, including extortion and bribery |

■Signing on to the Principles for Financial Action for the 21st Century

Financial Behavior Principles for the Formation of a Sustainable Society (Principles for Financial Action for the 21st Century) are action guidelines for financial institutions that want to fulfill the responsibilities and roles necessary for the formation of a sustainable society. They were put together by the Drafting Committee with the participation of diverse financial institutions in October 2011 and subsequently revised in June 2022.

Each signatory financial institution implements efforts according to the seven principles below as much as possible based on its business content. One of the features is that it is positioned as a starting point for collaboration without being restricted by factors such as format, scale and region.

Financial Behavior Principles for the Formation of a Sustainable Society (The Seven Principles)

| Principle 1 | Basic posture | Recognizing the responsibilities and roles that financial institutions themselves play for the formation of a sustainable society, we will take the initiative in implementing best practices through our businesses, aiming to create positive impacts on the environment, society and economy, and mitigate negative impacts. |

|---|---|---|

| Principle 2 | Contribution to a sustainable global society | We will lead the formation of a sustainable global society by developing and providing financial products and services that contribute to the creation and development of industries and businesses through innovation, toward steady and fair transitions in society. |

| Principle 3 | Contribution to the formation of sustainable communities | We will support the solution of environmental, social and economic issues based on regional characteristics, and lead the formation of sustainable local communities by improving the inclusiveness and resilience of the region. |

| Principle 4 | Human resource development | We will recognize the importance of human capital in financial institutions, and develop human resources who can think for themselves and take action on environmental and social issues. |

| Principle 5 | Collaboration with various stakeholders | Recognizing the importance of cooperation among various stakeholders, including financial institutions, in order to form a sustainable society, we will not only participate in such efforts but also play an active role. |

| Principle 6 | Building a sustainable supply chain | We will actively address environmental issues such as global warming and biodiversity and social issues such as human rights, and build a sustainable supply chain through constructive engagement with business partners including investees and borrowers. |

| Principle 7 | Information disclosure | Recognizing that activities to enhance the sustainability of society are management issues, we will disclose our efforts to a wide range of stakeholders and make constant improvements based on domestic and international trends and disclosure frameworks. |

The Asset Manager agrees with these seven principles and has become a signatory.

■Joining the World Wide Fund for Nature (WWF) Japan

World Wide Fund for Nature (“WWF”) was established in Switzerland in 1961 and is an environmental conservation organization active in over 100 countries. With the goal of people living in harmony with nature, the WWF is propelling efforts to realize a sustainable society. The organization promotes the conversation of endangered wild life in addition to sustainable production and consumption as a means to restore the richness of biodiversity, which is rapidly being lost, and to achieve a decarbonized society that prevents global warming.

World Wide Fund for Nature Japan (“WWF Japan”) was established in Tokyo as the 16th WWF organization in the world in 1971. The WWF Japan mainly engages in (1) activities, survey research, policy proposals, and the dissemination of ideas on environmental conservation to conserve biodiversity and reduce the environmental impact of humanity on the natural environment, (2) cooperation with the World Wide Fund for Nature Secretariat (WWF International) and coordination with other relevant organizations, and (3) other projects necessary to achieve its objectives.

The Asset Manager agrees with the significance of the activities of WWF Japan and supports WWF’s environmental conservation efforts as a corporate member.

■Eco Action 21 Certification and Registration

EcoAction 21 is a third-party evaluation program to certify and register organizations which implement appropriate environmental initiatives, establish, operate, and maintain an environmental management system, and promote environmental communication in accordance with the EcoAction 21 Guidelines (Note) formulated by the Ministry of Environment.

The Asset Manager underwent a subsequent review and received certification and registration.

- These guidelines formulated by the Ministry of the Environment define 14 action items (requirements) based on a PDCA cycle consisting of three factors: “environmental management system,” “environmental performance evaluation,” and “environmental reporting.”

■Joining the Japan Business Initiative for Biodiversity (JBIB)

The Japan Business Initiative for Biodiversity (hereinafter referred to as “JBIB,” established in April 2008) is a group of Japanese corporations actively working to conserve biodiversity, and through the following five activities aims to contribute to the conservation of biodiversity in Japan and abroad by promoting joint research among various corporations to produce results that cannot be achieved by a single corporation.

5 Objectives of JBIB

- To explore links between business and biodiversity and to use that knowledge in our business practices

- To promote dialogues and collaborations with stakeholders

- To share good practices within Japan and abroad

- To advocate and undertake educational efforts for the promotion of biodiversity conservation

- To conduct projects to fulfill the aforementioned objectives

The Asset Manager agrees with the significance of the activities of JBIB, and became the first asset manager of a J-REIT to join the initiative.

■Joining the 30 by 30 Alliance for Biodiversity

30 by 30 is an initiative to halt the loss of biodiversity and put it on a recovery track (nature positive) by 2030. The goal is to effectively conserve at least 30% of land and sea as healthy ecosystems by 2030. In April 2022, a coalition of volunteers formed to promote efforts to achieve this goal. The coalition is known as the 30 by 30 Alliance for Biodiversity (hereinafter referred to as the “Alliance”). As a specific action to achieve 30 by 30, the Asset Manager will provide assistance in managing protected areas and areas registered (or expected to be registered) in the global database of OECMs.(Note)

The Asset Manager agrees with the significance of the activities of the Alliance, and became the first asset manager of a J-REIT to join.

- Other Effective area-based Conservation Measures (OECMs): Areas outside of national parks and other protected areas in which biodiversity can be conserved effectively and over the long term.

■Environmental Performance

Energy consumption

| FY ended Mar. 2019 (base year) |

FY ended Mar. 2020 |

FY ended Mar. 2021 |

FY ended Mar. 2022 |

FY ended Mar. 2023 |

|

|---|---|---|---|---|---|

| Total consumption (kWh) | 77,075 | 78,930 | 89,817 | 103,372 | 95,310 |

| Consumption intensity (kWh/million yen) | 23.47 | 22.56 | 21.45 | 22.97 | 21.39 |

| Reduction rate of intensity (%) | - | -3.9% | -8.6% | -2.1% | -8.9% |

GHG emissions (Scope 2)

| FY ended Mar. 2019 (base year) |

FY ended Mar. 2020 |

FY ended Mar. 2021 |

FY ended Mar. 2022 |

FY ended Mar. 2023 |

|

|---|---|---|---|---|---|

| Total emissions (t-CO2) | 35.6 | 35.9 | 39.7 | 45.8 | 43.5 |

| Emissions intensity (t-CO2/million yen) | 0.0108 | 0.0103 | 0.0095 | 0.0102 | 0.0098 |

| Reduction rate of intensity (%) | - | -5.3% | -12.6% | -6.1% | -10.0% |

-

Aggregation period

The aggregation period is from every April to the following March. Results are updated annually in principle. -

Calculation method

Calculated based on electricity usage consumed by the Asset Manager in its office.

Energy consumption intensity and GHG emissions intensity are calculated by dividing total electricity usage and CO2 emissions

by intensity denominator (gross sales (million yen)).

■Diversity, equity, and inclusion

For the Daiwa House Group to grow into a corporate capable of contributing to the world, it is important to respond flexibly to diverse values and ongoing changes in society, and to create new value to allow us to discover potential markets. Toward that end, we must foster a workplace climate that makes it possible to capitalize on the perspectives and creativity stemming from employees’ diverse values, gender, age, ethnicity, language, culture, disabilities, lifestyles, and other attributes in order to form organizations that generate new ideas without being held back by outdated notions and preconceptions.

We are making efforts to promote active participation by women and otherwise strengthen diversity-based management so that a broader range of people can flourish in the future.

KPI

| Item | Fiscal year ended March 2023 | Target for fiscal year ending March 2031 |

|---|---|---|

| Diversity, equity, and inclusion | ||

| Percentage of female managers (senior manager and above) | 20.7% | 39% |

| Percentage of female line managers (group leader and above) | 0% | 20% |

| Work styles (work-life balance) | ||

| Percentage of male employees taking childcare leave | 83.3% | 100% |

| Percentage of paid leave taken | 72.4% | 85% |

| Engagement | ||

| Turnover | 1.4% | 0% |

| Average tenure of employees | 5.6 years | 10 years |

| eNPS score | -13 | -8 |

■eNPS Surveys and Satisfaction Evaluations

In 2022, the Asset Manager conducted eNPS(Note) surveys and satisfaction evaluations through third-party organizations for officers and employees, including fixed-term, temporary, and part-time employees. The Asset Manager explains the survey results to officers and employees (including fixed-term, temporary employees, and part-time employees), gives feedback, and encourages them to build a better workplace environment.

- The Employee Net Promoter Score is an index for visualizing the loyalty of employees. This index evaluates eleven levels of employee loyalty through the survey question asking, “How likely are you to recommend our organization to your family, friends, or other acquaintances who want to find or change jobs in the same industry as your company? Please answer by assuming that you have friends or other acquaintances who want to find or change jobs in the industry that you are working in.”

■Sustainability Surveys for Employees

The Asset Manager recognizes human resources as its greatest asset and participates in the Sustainability Survey (formerly CSR Awareness Survey) conducted by the Daiwa House Group (Note) every year to verify how well the Principles of Corporate Ethics and Code of Conduct are being practiced in the workplace and the employment satisfaction level (100% response rate). The Asset Manager explains the survey results to officers and employees (including fixed-term employees, temporary employees and part-time employees), gives feedback, and encourages them to build a better workplace environment.

- Surveys and analyses are outsourced to third-party institutions.

■Labor Standards

The Asset Manager has not yet organized a labor union but does recognize the constitutional right of every employee to have “freedom of association.” The Asset Manager has also signed and made a commitment to adhering to the United Nations Global Compact, one of whose principles is “the freedom of association and the effective recognition of the right to collective bargaining.”

Labor-management relations at the Asset Manager have been harmonious, and there have been no large-scale mergers, acquisitions, or layoffs in the past three years.

In addition, the Asset Manager has entered into a labor-management agreement on overtime work (36 Agreement) with its employees, and striven to maintain the health of its employees by appropriately managing working hours.

■Overwork

The Asset Manager conducts mandatory health examinations through industrial physicians for anyone who works more than 80 hours of overtime per month.

■Establishment of Health Committee

The Asset Manager has established a Health Committee that meets monthly to exchange opinions on the workplace environment and learn about health with the industrial physician in order to prevent health problems among officers and employees and maintain and promote their health.

In addition, stress checks are conducted once a year for the purpose of preventing mental disorders.

■Personnel Data

| Item | FY ended Mar. 2019 | FY ended Mar. 2020 | FY ended Mar. 2021 | FY ended Mar. 2022 | FY ended Mar. 2023 |

|---|---|---|---|---|---|

| Total personnel(Note 1) | 61 | 60 | 59 | 64 | 70 |

| Male personnel / percentage of total | 43 / 70.5% | 42 / 70.0% | 40 / 67.8% | 39 / 60.9% | 45 / 64.3% |

| Female personnel / percentage of total | 18 / 29.5% | 18 / 30.0% | 19 / 32.2% | 25 / 39.1% | 25 / 35.7% |

| Manager(Note 1) (Note 2) | 21 | 22 | 27 | 28 | 29 |

| Male personnel / percentage of total | 21 / 100.0% | 21 / 95.5% | 24 / 88.9% | 23 / 82.1% | 23 / 79.3% |

| Female personnel / percentage of total | 0 / 0.0% | 1 / 4.5% | 3 / 11.1% | 5 / 17.9% | 6 / 20.7% |

| New hires | 2 | 2 | 13(Note 6) | 5(Note 6) | 0 |

| Male personnel / percentage of total | 1 / 50.0% | 2 / 100.0% | 4 / 31.0% | 5 / 100.0% | 0 / 0% |

| Female personnel / percentage of total | 1 / 50.0% | 0 / 0.0% | 9 / 69.0% | 0 / 0.0% | 0 / 0% |

| Job leavers | 1 | 7 | 2 | 2 | 1 |

| Turnover(Note 3) | 1.6% | 11.7% | 3.4% | 3.1% | 1.4% |

| Monthly average overtime hours | 12.0 hours | 12.8 hours | 13.6 hours | 15.4 hours | 16.5 hours |

| Average tenure | 4.2 years | 4.8 years | 5.1 years | 5.0 years | 5.6 years |

| Male personnel | 4.2 years | 4.8 years | 5.2 years | 5.4 years | 5.5 years |

| Female personnel | 4.0 years | 4.8 years | 4.7 years | 4.3 years | 5.6 years |

| Percentage of personnel who had stress checks | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Number of employees who took parental leave / number of employees who returned to work | 0 / 0 | 1 / 1 | 3 / 1 | 3 / 2 | 8 / 5 |

| Male personnel | 0 / 0 | 1 / 1 | 1 / 1 | 0 / 0 | 5 / 5 |

| Female personnel | 0 / 0 | 0 / 0 | 2 / 0 | 3 / 2 | 3 / 0 |

| Return rate | 0.0% | 0.0% | 33.3% | 66.7% | 62.5% |

| M&As | 0 | 0 | 0 | 0 | 0 |

| Employee lay offs | 0 | 0 | 0 | 0 | 0 |

| Number of employees who took elder caregiving leave | 0 | 0 | 0 | 0 | 1 |

| Number of employees aged 60 and older | 0 | 0 | 1 | 1 | 2 |

| Number of employees who are foreign nationals | 0 | 0 | 0 | 0 | 0 |

| Number of employees belonging to ethnic minorities(Note 4) | 0 | 0 | 0 | 0 | 0 |

| Number of employees with disabilities | 0 | 0 | 0 | 0 | 0 |

| Average days of annual paid vacation taken / paid vacation usage rate | 12.7 days / 68.6% | 12.5 days / 66.3% | 13.1 days / 71.7% | 13.1 days / 71.3% | 13.6 days / 72.4% |

| Percentage of personnel who had health checkup | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Occupational accident frequency rate(Note 5) | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

- Headcounts are as of April 1 of each fiscal year.

- Senior manager and above.

- Turnover is the ratio of job leavers to total personnel as of April 1 of each fiscal year.

- Ethnic minorities, immigrants, refugees, etc.

- Occupational accident frequency rate = (occupational injuries/fatalities total actual hours worked) x 1,000,000

- This figure includes a new graduate hired as an employee.

■Payment of Wages Above Minimum Wage and Equal Pay for Equal Work

The Asset Manager pays wages above the minimum wage provided for in laws and regulations and a wage that contributes to improving the standard of living by taking into account the commodity prices. Our compensation system also maintains equal pay for equal work and ensures no wage gap between genders. The Asset Manager has established an evaluation-linked monetary compensation system by post classification and conducted appropriate assessments of performance. Bonuses are paid twice a year in the summer and the winter, and the amount is determined according to work performance. In the fiscal year ended March 2023, the average annual salary paid by the Asset Manager was ¥9,802 thousand(Note).

- Average for full-time employees not including officers, fixed-term employees or employees on external assignment

■Benefits and Welfare

The Daiwa House Group recognizes the importance of promoting good health among its workforce and thereby improving labor productivity through consistent measures to eliminate excessively long working hours and help employees manage their health.

Based on such recognition, the Asset Manager has introduced employee leave/vacation programs such as the one to the right, in addition to celebratory event leave, bereavement leave, maternity/paternity leave (Note), child caregiving leave and elder caregiving leave (Note).

- Contract workers can also take advantage of these programs.

| Item | Overview |

|---|---|

| Special paid vacation | Up to five days per year separately from annual paid vacation to promote employees’ health, etc. |

| Accumulated paid vacation | Unused annual paid vacation days accumulate up to 20 days per year to a maximum of 100 days. Employees may use their accumulated paid vacation days as personal injury/sick leave, maternity/paternity leave, family caregiving leave or community co-creation leave |

| Family caregiving leave | Five days per year to care for ill family members (paid leave) |

| Community co-creation leave | Five days per year to participate in activities that contribute to society, training for such activities, etc. (paid leave) |

■Introduction of Cumulative Investment Unit Investment Program

In December 2013, the Asset Manager introduced a cumulative investment unit investment program in the aim of increasing the price of DHR investment units and further improving growth of DHR and medium- to long-term investor value by having officers and employees of the Asset Manager pay close attention to investment unit prices of DHR and raising their awareness of performance.

■Introduction of Investment Unit Ownership Program

In November 2019, the Asset Manager introduced an investment unit ownership program of DHR for its officers and employees in response to the Japan Securities Dealers Association’s issuance of guidelines on investment unit ownership programs in May 2018.

- Daiwa House introduced an investment unit ownership program of DHR for its officers in November 2018, and for its employees in June 2020.

■Internal Reporting System and Whistleblower Protections

The Asset Manager has established whistleblower liaisons internally and externally and set up a process to appropriately handle consultations with or reports from whistleblowers on organizational or personal conduct that poses (or may pose) compliance issues, including violations of laws/regulations and ethically problematic conduct, in accord with the Whistleblower Protection Act and the Cabinet Office’s Whistleblower Protection Act guidelines for private businesses.

Additionally, whistleblowers are protected from prejudicial treatment in any form.

■Policy on and Approach to Human Resources Development

As stated in its Company Philosophy (Corporate Creed), the Daiwa House Group aims to “develop people through business.” We believe that human resources are the Group’s greatest assets.

To take advantage of the abilities and unique talents of our employees and develop human resources capable of contributing to society, we implement various training and programs that combine on-the-job and off-the-job training.

Learn more about Daiwa House Group’s human approach and policies regarding human resources development

■Target Management and Performance Evaluation Program

The Asset Manager has introduced and implemented a target management and performance evaluation program semiannually to (1) foster communication between superiors and subordinates, (2) strengthen human resource development, (3) increase motivation with respect to roles and results (performance), and (4) clarify evaluation criteria and gain better understanding of evaluations.

Employee performance evaluations are determined by evaluation of performance benchmarked against individualized targets, evaluation of skills/conduct and a compliance evaluation. The issues for improvement are shared through the performance review and follow-up interviews.

Additionally, “ESG initiatives in response to societal demands” was added as a performance evaluation criterion from the second half of fiscal year ended March 2019.

■Support for Operational Skills Development and Training

The Asset Manager has established a system for providing funding for the registration and renewal of professional qualifications and a system for providing congratulatory payments for acquiring professional qualifications to encourage the acquisition of knowledge, qualifications, and licenses. The purpose is to increase the motivation of all employees (including fixed-term employees, temporary employees, and part-time employees) with respect to self-development, improve their abilities and talents, continuously and steadily secure human resources with the specialized skills necessary to contribute to the achievement of business objectives, and assess the environmental friendliness of DHR’s properties.

Number of the Asset Manager’s employees with qualifications (Total of 71 officers and employees as of March 31, 2023)

| Item | Number of people with qualifications (Note) |

|---|---|

| ARES (Association for Real Estate Securitization) Certified Master | 33 |

| Real Estate Transaction Agent | 64 |

| Real Estate Appraiser | 2 |

| First-Class Architect | 2 |

| Certified Real Estate Consulting Master | 8 |

| Office Building Manager | 9 |

| TOEIC score of 700+ | 9 |

| CASBEE Accredited Professional for Buildings | 2 |

| CASBEE Accredited Professional for Real Estate | 4 |

- Includes personnel who have passed the credentialing exam but are not yet credentialed.

KPIs and Main Initiatives

| Qualification | Fiscal year ended March 2023 |

Target for fiscal year ending March 2031 |

|---|---|---|

| Real Estate Transaction Agent | 90.1% | 100% |

| ARES (Association for Real Estate Securitization) Certified Master | 46.4% | 50% |

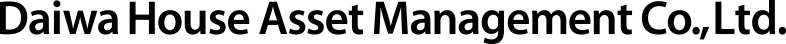

■Training System and Schedule

■New Employee Training Program

To help new employees acquire operational knowledge as quickly as possible, the Asset Manager provides training on the following topics:

●Explanation of the operations of each department ●Compliance ●Insider trading regulations ●Human rights ●System-related risks ●Email use ●Etiquette ●Disaster prevention/crisis management ●CSR ●Basic knowledge related to buildings ●Basic knowledge related to J-REIT, etc.

■Training on Operational Expertise

The Asset Manager provides training on the topics below to officers and employees (including temporary employees and part-time employees), by also utilizing training by external experts.

| Program | FY ended Mar. 2019 | FY ended Mar. 2020 | FY ended Mar. 2021 | FY ended Mar. 2022 | FY ended Mar. 2023 |

|---|---|---|---|---|---|

| Sustainability training | 1 | 1 | 1 | 1 | 4 |

| Training for general managers and above | 0 | 1 | 0 | 0 | 1 |

| Training for senior managers and group managers | 0 | 1 | 0 | 0 | 4 |

| Middle-management employee training | 0 | 0 | 0 | 0 | 6 |

| OJT trainer training | 0 | 0 | 0 | 5 | 7 |

| Young employee training | 0 | 0 | 0 | 1 | 2 |

| Real estate market training | 5 | 5 | 5 | 4 | 4 |

| New hire training | 3 | 4 | 5 | 4 | 2 |

| Other training | 4 | 4 | 18 | 1 | 9 |

| Architectural training | 0 | 0 | 10 | 0 | 9 |

Training Hours and Expenses for Officers and Employees

| Fiscal year ended March 2023 | |

|---|---|

| Training hours | 31.5 hours/person/year |

| Training expense | ¥91,039/person/year |

■Human Resources Dispatched from Sponsor

The Asset Manager has received from the sponsor human resources with a wealth of experience in areas such as real estate sales transactions, leasing, property management, finance and IT system operations. Learn more about Daiwa House Group’s human resource development philosophy and policies

■Business Continuity Plan (BCP)

The Asset Manager establishes the necessary items for its disaster prevention and crisis management in relation to risks specified separately for natural disasters such as large-scale earthquakes, accidents, crimes, and other material facts. It has established an “Emergency Response Manual” in order to prevent and avoid risk, ensure people’s safety and reduce/mitigate damage in the event of a disaster, prevent secondary accidents, resume DHR’s asset management operations at an early point, and fulfill its corporate social responsibility. Furthermore, to ensure continuity of payment and disclosure operations from the standpoint of the business continuity requirements to which financial instrument business operators are subject, the Asset Manager plans to operate in accordance with a BCP Execution Plan it has formulated.

The Asset Manager has stockpiled supplies, including three days of emergency meals and drinking water for officers and employees and two storage batteries, at its office, warehouse for general affairs and elsewhere.

■Support for Community Activities

The Asset Manager supports community co-creation activities, partly through “Community Co-Creation Leave Program” it has established to facilitate employees’ participation in activities that contribute to society, training for such activities and other such endeavors. Community co-creation activities supported by the Asset Manager include (1) preservation of the natural environment (litter pickup activities, recycling movements), (2) education and youth development (school visits, experiential learning programs, athletic coaching), (3) social welfare (elder/juvenile/disabled welfare), (4) international cooperation (overseas volunteering, foreign language interpreting, etc.), (5) volunteer training and required credentialing programs (classes in invalid care skills, sign language), (6) community outreach (neighborhood association events) and (7) disaster relief activities. Specific activities include litter cleanup activities in response to calls from public park and facility management offices, participation in a book donation project, and volunteering for daily conversational practice for elderly Chinese returnees to learn Japanese conversation and interact with others in Japanese.

A litter cleanup activity in response to a public park authority’s call for volunteers

Learn more about Daiwa House Group’s track record of community co-creation activities

■Violations/Accidents by Officers and Employees

There were no significant violations committed by or accidents involving the Asset Manager’s officers and employees that would influence stakeholders. (Fiscal year ended March 2023)