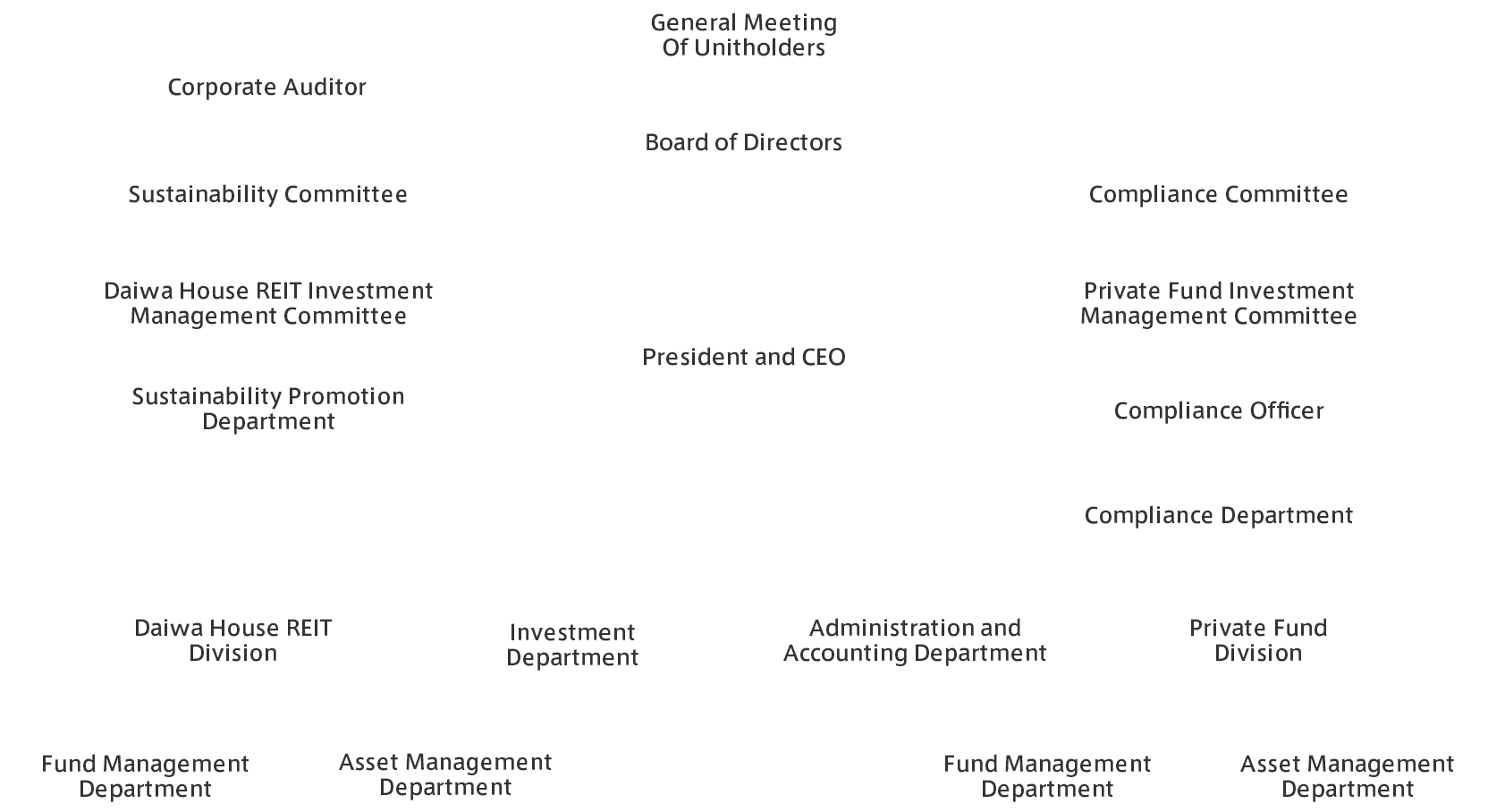

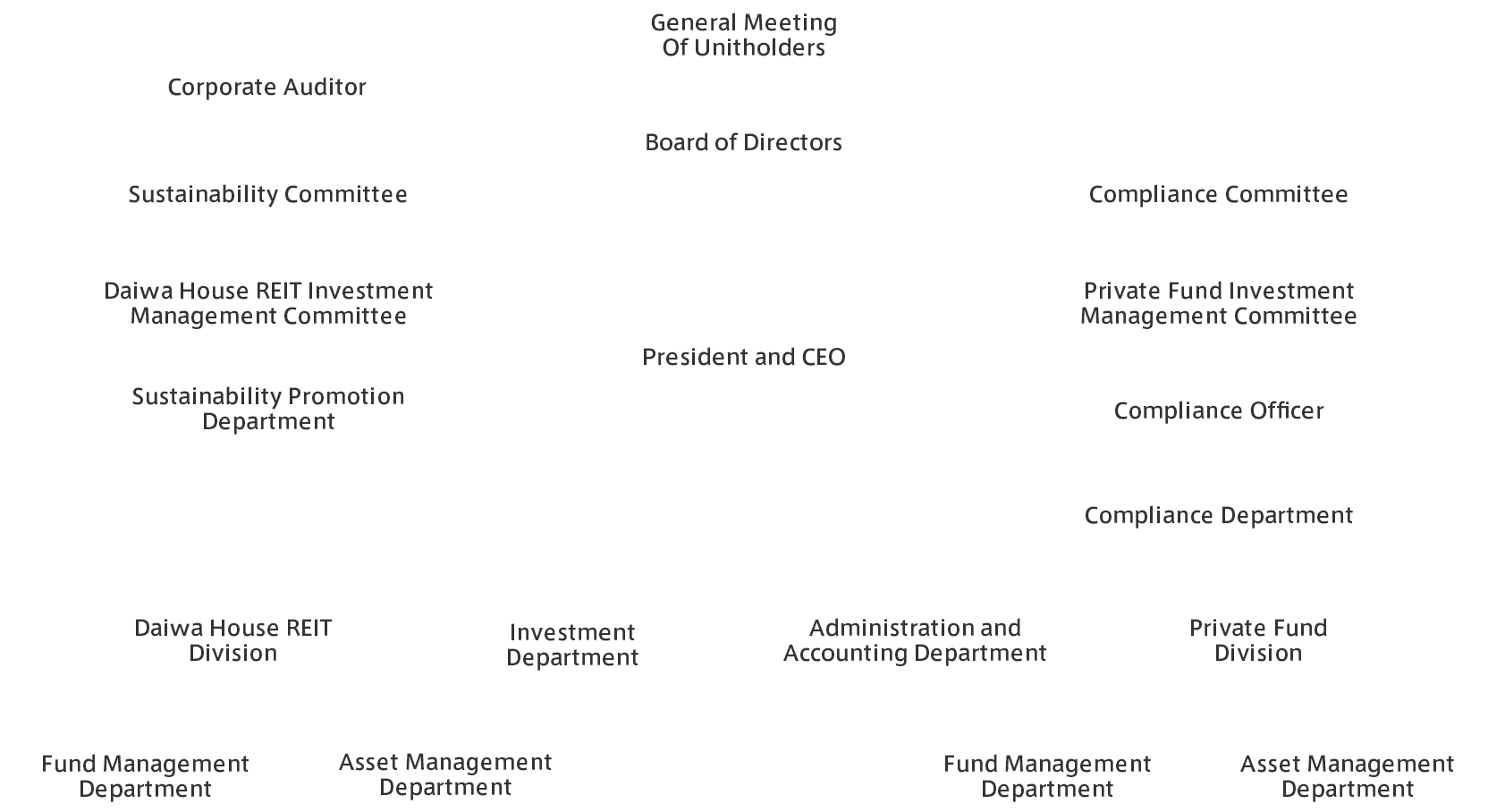

| Department |

Allocation of Duties |

| President and CEO |

General management of the execution of overall businesses of the Asset Manager |

| Compliance Officer |

- Planning, drafting and promotion of general compliance

- Verification of compliance with laws and regulations and risk management with respect to overall businesses

- Verification of appropriateness of handling of complaints, etc.

- Verification of appropriateness of management of information

- General management of internal auditing

- General management of business execution of the Compliance Department

- Other matters attendant upon or related to the above items

|

| Compliance Department |

- Verification and supervisory guidance of compliance with laws, regulations, and internal company rules, etc.

- Drawing up policies and plans for internal auditing, and carrying out internal auditing

- Matters related to compliance policy

- Matters related to laying out and revising compliance manuals

- Matters related to implementation of compliance-related in-house training

- Matters related to drawing up and enforcing a structure to eliminate antisocial forces

- Matters related to litigation actions and execution and preservation actions

- Matters related to verification of the state of risk management

- Screening of advertisements and appropriateness of disclosed information

- Other matters attendant upon or related to the above items

|

| Sustainability Promotion Department

|

- Matters related to sustainability-related policy, strategy development, and planning

- Matters related to sustainability-related research and analysis

- Matters related to sustainability-related disclosure

- Matters related to global environmental issues such as climate change

- Matters related to membership and signatures to environmental organizations, etc.

- Matters related to obtaining and responding to sustainability-related evaluations

- Matters related to overall sustainability-related management of the portfolio of DHR and individual funds (the “Private Fund”) for which the Asset Manager has entered into investment advisory or discretionary investment management agreements and the Asset Manager

- Matters related to obtaining and responding to environmental certifications and other environmental measures of the assets held by DHR and the Private Fund

- Matters related to implementation of sustainability-related in-house training and other activities

- Matters related to operations of the Sustainability Committee

- Other matters attendant upon or related to the above items

|

| Investment Department |

- Matters related to acquisition and disposition of properties related to the investment management business and investment advisory business

- Research and analysis of real estate transaction market

- Collection and analysis of investment information

- Other matters attendant upon or related to the above items

|

Fund Management Department

Daiwa House REIT Division |

- Matters related to DHR’s management planning

- Matters related to DHR’s capital policy, finance strategy, and fund raising

- Matters related to developing and planning of DHR’s portfolio strategy

- Matters related to overall management of DHR’s portfolio

- Matters related to DHR’s dividend policy and earnings distribution

- Matters related to DHR’s advertising, marketing, and public relations activities

- Matters related to DHR’s timely disclosure of information of DHR

- Research and analysis of real estate market, financial and capital markets, and real estate investment trust market

- Other matters attendant upon or related to the above items

|

Asset Management Department

Daiwa House REIT Division |

- Matters related to management of assets of DHR

- Matters related to overall operation and management of DHR’s portfolio assets

- Matters related to additional investment in DHR’s portfolio assets

- Other matters attendant upon or related to the above items

|

Fund Management Department

Private Fund Division |

- Matters related to strategy development and planning of the Private Fund

- Matters related to fund raising of the Private Fund

- Matters related to account settlement of the Private Fund

- Other matters attendant upon or related to the above items

|

Asset Management Department

Private Fund Division |

- Matters related to advisory service regarding acquisition, disposition, and investment management of assets under the investment advisory agreements, or executory service regarding acquisition, disposition, and investment management under the discretionary investment agreements, and other ancillary services

- Matters related to advisory service or executory service regarding overall operation and management of portfolio assets of the Private Fund that a customer acquires through an investment advisory agreement or discretionary investment agreement

- Matters related to advisory service or executory service regarding additional investment to portfolio assets of the Private Fund that a customer acquires through an investment advisory agreement or discretionary investment agreement

- Other matters attendant upon or related to the above items

|

| Administration and Accounting Department |

- Matters related to management planning

- Matters related to general affairs, human resources, public relations, and accounting

- Matters related to accounting of DHR

- Matters related to information security

- Managing corporate-related information to prevent insider trading

- Matters related to information systems

- Matters related to personal information

- Receipt of complaints, etc.

- Matters related to filings with public authorities

- Matters related to dealing with unitholders and general unitholders meetings

- Matters related to operations of general shareholders meetings and board of directors meetings

- Matters related to execution, termination, and amendment of the asset management agreements

- Acting as a contact point for industry groups and other parties

- Matters related to documentation and management of account books and reports as the department responsible for organizing documents

- Other matters attendant upon or related to the above items

|

| Compliance Committee |

- Deliberations and resolutions on transactions with interested parties (defined in the “Interested - Party Transaction Rules”) in the investment management business and investment advisory business

- Deliberations or resolutions on compliance with respect to matters for resolutions at board of directors meetings other than those matters set out in the preceding item

- Deliberations or resolutions on compliance of other matters that the Compliance Officer requires deliberations or resolutions at meetings of the Compliance Committee

- Verification of risks and risk management concerning asset management pertaining to the investment management business and investment advisory business

- Other deliberations or resolutions related to matters attendant upon or related to the above items

|

| Sustainability Committee |

- Deliberations and resolutions on sustainability-related policy and strategy development

- Deliberations and resolutions on execution of sustainability-related operations

- Other deliberations or resolutions related to matters attendant upon or related to the above items

|

Daiwa House REIT

Investment Management Committee |

- Deliberations and resolutions on basic matters of DHR

- Deliberations and resolutions regarding DHR’s investment policy

- Deliberations and resolutions regarding the acquisition, disposition, and investment management of DHR’s assets

- Deliberations and resolutions, etc. on important matters concerning management planning, finance, accounting, and IR of DHR

- Other deliberations or resolutions related to matters attendant upon or related to the above items

|

Private Fund

Investment Management Committee |

- Deliberations and resolutions regarding strategy development of the Private Fund

- Deliberations and resolutions regarding advisory service for acquisition, disposition, and investment management of assets under the investment advisory agreements, or executory service for acquisition, disposition, and investment management under the discretionary investment agreements, and other ancillary services.

- Deliberations and resolutions regarding fund raising of the Private Fund

- Deliberations and resolutions regarding other matters attendant upon or related to the above items

|